All Categories

Featured

Table of Contents

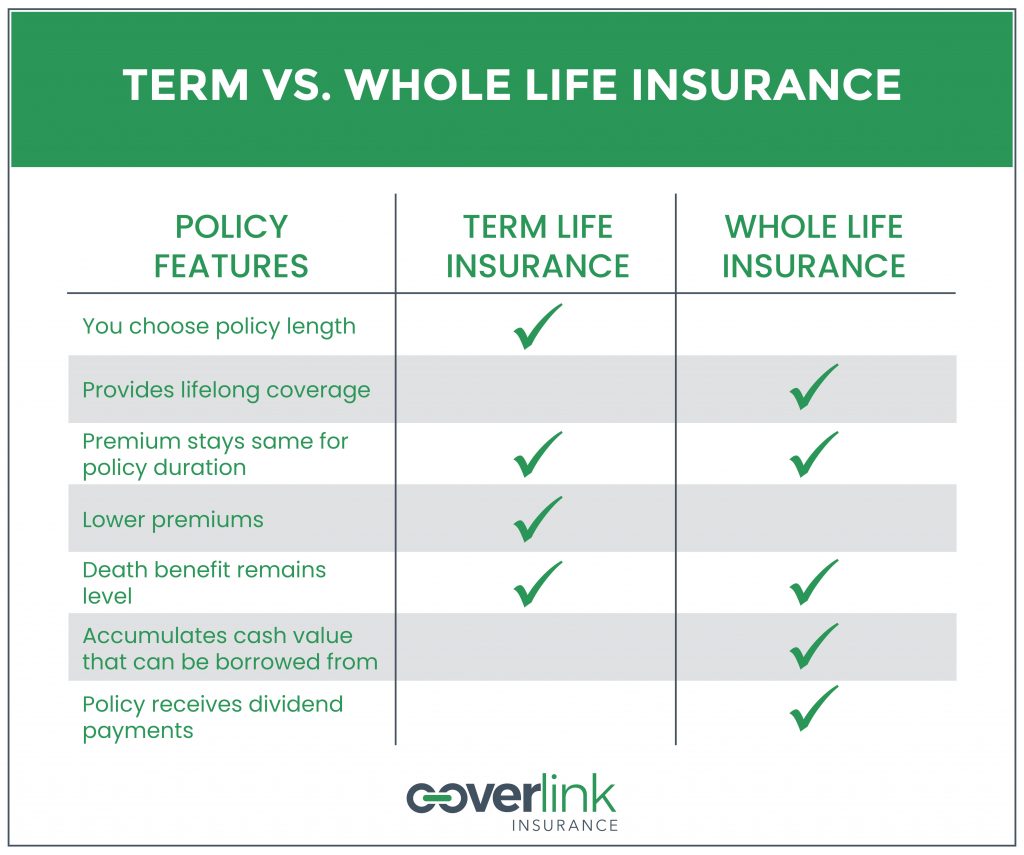

Level term life insurance policy is among the most inexpensive insurance coverage choices on the market because it supplies fundamental security in the form of survivor benefit and only lasts for a set time period. At the end of the term, it expires. Entire life insurance policy, on the various other hand, is considerably a lot more costly than level term life since it does not run out and features a money worth attribute.

Rates might vary by insurer, term, insurance coverage amount, health and wellness class, and state. Degree term is an excellent life insurance choice for a lot of people, but depending on your coverage requirements and individual scenario, it could not be the finest fit for you.

How long does Best Level Term Life Insurance coverage last?

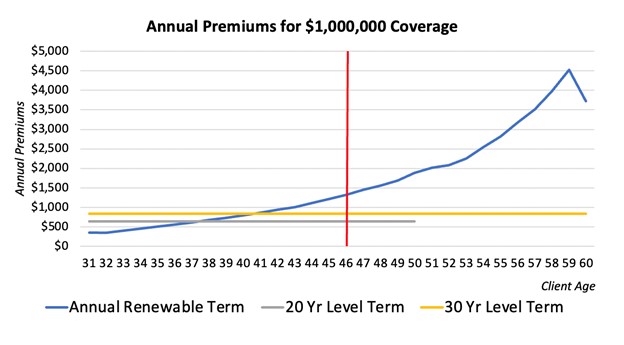

Annual renewable term life insurance policy has a regard to just one year and can be restored every year. Yearly renewable term life premiums are initially reduced than level term life costs, but prices go up each time you restore. This can be a great option if you, for instance, have simply stop cigarette smoking and need to wait 2 or 3 years to apply for a degree term plan and be eligible for a reduced price.

, your fatality benefit payout will certainly lower over time, yet your settlements will remain the exact same. On the other hand, you'll pay even more ahead of time for much less coverage with an increasing term life plan than with a degree term life policy. If you're not certain which type of policy is best for you, working with an independent broker can help.

What is Level Term Life Insurance Coverage?

Once you've determined that degree term is right for you, the following step is to acquire your policy. Here's exactly how to do it. Calculate just how much life insurance you require Your insurance coverage quantity ought to offer your family members's long-term financial requirements, consisting of the loss of your revenue in case of your death, as well as financial debts and everyday costs.

As you search for means to protect your monetary future, you've likely stumbled upon a large range of life insurance policy options. Choosing the ideal insurance coverage is a large decision. You want to find something that will certainly aid support your enjoyed ones or the causes crucial to you if something happens to you.

Many individuals favor term life insurance for its simpleness and cost-effectiveness. Term insurance agreements are for a relatively short, specified duration of time yet have options you can customize to your demands. Specific benefit options can make your premiums change over time. Degree term insurance, however, is a sort of term life insurance policy that has regular repayments and a constant.

What does Level Term Life Insurance Premiums cover?

Degree term life insurance coverage is a subset of It's called "level" due to the fact that your costs and the advantage to be paid to your liked ones continue to be the same throughout the agreement. You will not see any type of modifications in cost or be left questioning its worth. Some agreements, such as every year eco-friendly term, might be structured with costs that enhance with time as the insured ages.

They're figured out at the beginning and continue to be the exact same. Having consistent repayments can aid you far better plan and budget since they'll never ever change. Low cost level term life insurance. Dealt with survivor benefit. This is likewise set at the start, so you can recognize specifically what survivor benefit amount your can expect when you die, as long as you're covered and updated on premiums.

How do I cancel Level Term Life Insurance Benefits?

You agree to a set costs and death advantage for the period of the term. If you pass away while covered, your fatality benefit will be paid out to liked ones (as long as your costs are up to date).

You may have the option to for one more term or, most likely, restore it year to year. If your contract has a guaranteed renewability condition, you may not require to have a new clinical examination to maintain your insurance coverage going. Your costs are most likely to enhance due to the fact that they'll be based on your age at renewal time.

With this option, you can that will last the remainder of your life. In this instance, once more, you may not require to have any type of brand-new medical examinations, however premiums likely will rise due to your age and new insurance coverage. Different companies supply various alternatives for conversion, make sure to recognize your selections prior to taking this step.

Speaking to a monetary consultant likewise may help you establish the path that aligns best with your overall method. Most term life insurance policy is level term for the duration of the contract period, however not all. Some term insurance coverage may include a costs that boosts gradually. With decreasing term life insurance coverage, your fatality advantage decreases over time (this kind is frequently obtained to especially cover a long-term debt you're repaying).

Why is Level Term Life Insurance important?

And if you're established up for sustainable term life, then your premium likely will rise annually. If you're checking out term life insurance policy and intend to make sure straightforward and foreseeable monetary defense for your family, level term might be something to think about. Nonetheless, similar to any kind of coverage, it might have some restrictions that don't meet your demands.

Usually, term life insurance policy is a lot more cost effective than long-term protection, so it's a cost-effective method to safeguard economic protection. Adaptability. At the end of your agreement's term, you have multiple options to proceed or carry on from protection, frequently without needing a medical test. If your budget or insurance coverage requires adjustment, survivor benefit can be reduced gradually and result in a reduced costs.

How long does Affordable Level Term Life Insurance coverage last?

As with other kinds of term life insurance, once the contract ends, you'll likely pay higher costs for coverage due to the fact that it will recalculate at your current age and wellness. Degree term provides predictability.

However that does not imply it's a fit for everyone. As you're looking for life insurance policy, right here are a couple of vital variables to consider: Spending plan. Among the benefits of level term insurance coverage is you understand the price and the death benefit upfront, making it much easier to without bothering with increases gradually.

Generally, with life insurance policy, the much healthier and younger you are, the extra economical the protection. Your dependents and monetary responsibility play a duty in establishing your insurance coverage. If you have a young family members, for instance, degree term can help give monetary assistance during crucial years without paying for coverage longer than required.

Latest Posts

Burial Insurance Quotes Online

National Burial Insurance Company

Best Way To Sell Final Expense Insurance